Contents:

So, when https://1investing.in/ account balances between different periods, there are likely to be variances. This results in variations since balances for each period are compared sequentially. You can make your current year look better if you choose historical periods of poor performance as your base comparison year. The comparative financial statements of Synotech, Inc., will serve as a basis for an example of horizontal analysis and vertical analysis of a balance sheet and a statement of income and retained earnings. Recall that horizontal analysis calculates changes in comparative statement items or totals, whereas vertical analysis consists of a comparison of items on a single financial statement.

By comparing historical financial information you can easily determine your growth and position compared to your competitors. By looking at the numbers provided by a company, you should see whether there are any large differences between one year and the next. It is also possible to perform this analysis with time series data to make direct comparisons with other companies. For example, if a company starts generating low profits in a particular year, expenses can be analyzed for that year.

Ideally, the horizontal and vertical analysis are combined to paint a comprehensive picture of a company’s financial performance over time. The process of comparing data points over time obviously requires at least two data sets to be available. You can perform horizontal analysis on any financial statement metric, financial ratio, or financial statement line item. Financial analysis of an income statement can reveal that the costs of goods sold are falling, or that sales have been improving, while return on equity is rising. Income statements are also carefully reviewed when a business wants to cut spending or determine strategies for growth.

Overview of Horizontal Analysis

Different ratios, such as earnings per share or current ratio, are also compared for different accounting periods. The key advantage of using horizontal analysis is that it allows for the visual identification of anomalies from long-running trends. By presenting data on a comparative basis, changes in the data are more readily apparent. In addition, the use of horizontal analysis makes it easier to project trends into the future. Yet another advantage of this form of data presentation is when trends can be compared to those of competitors or industry averages, to see how well an organization’s performance compares with that of other entities.

- A vertical analysis is a way to take apart an item on your balance sheet or income statement and look at the individual pieces that make up that item.

- This can be useful in checking whether a company is performing well or badly, and identify areas where it may improve.

- Horizontal and vertical analysis are two types of analysis you can do that use simple mathematical formulas.

- This can create difficulties in detecting troublesome areas, making it hard to spot changes in trends.

The horizontal analysis is a way to look at your company’s financial statements and see how they compare to each other. It involves looking at the income statement and balance sheet, as well as other factors like the cash flow statement. One horizontal analysis example in financial accounting is when you are analysing a company’s income statement and balance sheet. When conducting horizontal analysis of an income statement, you would analyse how revenue from different sources has changed over time or how the balance sheet shows different types of assets and liabilities.

Definition of Horizontal Analysis

Horizontal analysis can help you identify trends in your data using your financial statements. Using Excel or Google Sheets is a great way to carry out a horizontal analysis of financial statements, especially if you use a pre-made template. If you use Layer, you can even automate parts of this process, including the control of data flows, calculations, and sharing the results. Horizontal analysis is often referred to as trend analysis, but the latter term has broader applications and is not specific to financial statements. As the name suggests, trend analysis involves identifying trends and predicting outcomes, which requires analyzing data from multiple consecutive periods.

In this first example, I will be doing a florida income tax rate of Company A’s revenue based on its annual income statement. Select the base and comparison periods and the values for your chosen variable, then calculate the percentage change between them. Calculating this involves subtracting the base period’s value from the comparison period‘s value, dividing the result by the base period’s value, then multiplying by 100. The presentation of the changes from year to year for each line item can be analyzed to see where positive progress is occurring over time, such as increases in revenue and profit and decreases in cost. Conversely, less favorable readings may be isolated using this approach and investigated further.

Types of Analysis

This analysis compares line items within the same financial statement and identifies each item’s relative importance. The formula calculates the percentage change between the current year amount and the base year amount for each line item in a financial statement. The percentage change indicates how much the line item has increased or decreased over time. Comparability means that a company’s financial statements can be compared to those of another company in the same industry.

This formula for evaluation is typically done by either investors and internal company management since both need to understand how well a company is doing in order to make decisions. Investors have to make the decision whether or not they want to invest or sell their current investment; while management needs to know what moves to make in order to improve the future performance of the company. In addition to helping you determine your company’s current financial health, this understanding can help you predict future opportunities, decide on business strategy, and create meaningful goals for your team. Calculate the average gross profit margin percentage by dividing your total gross profit by your total sales amount from Step 1.

Seasonal temperatures in West Antarctica during the Holocene – Nature.com

Seasonal temperatures in West Antarctica during the Holocene.

Posted: Wed, 11 Jan 2023 08:00:00 GMT [source]

The technique shows whether or not the company is expanding and appreciating in terms of value. Therefore, an investor can easily track a company’s earnings per share ratio, using this analysis balance sheet before making an investment decision. If the analysis shows constant growth year after another, it means that there is a positive trend. So, any investor would most likely prefer to invest in the company and vise versa.

Segregating Accounting Duties In Your Landscaping Business

Horizontal analysis allows investors and analysts to see what has been driving a company’s financial performance over several years and to spot trends and growth patterns. This type of analysis enables analysts to assess relative changes in different line items over time and project them into the future. It’s frequently used in absolute comparisons, but can be used as percentages, too.

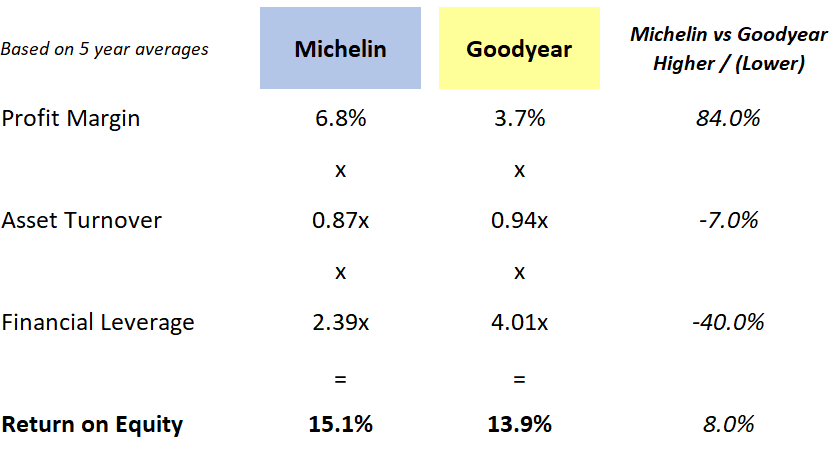

Ratio Analysis of a Company: Comparing Companies’ Financials – Investopedia

Ratio Analysis of a Company: Comparing Companies’ Financials.

Posted: Wed, 06 Apr 2022 07:00:00 GMT [source]

This will give you an idea of how much money you make on each sale and how many sales must be made in order for you to break even on those sales costs. Horizontal Analysis is performed by placing multiple years’ worth of data lined up next to each other and then graphing the data points to determine if there is a trend, and where it is going. A horizontal analysis of the trends in solvency ratios will reveal if the company is increasingly insolvent or stably solvent.

GL Accounts: What Are They and How Do They Work in Double-Entry Accounting

Is often used by investors or creditors to evaluate risk and corporate finance profiles.

For example, comparing the accounts receivables of one year to those of the previous year. Trends or changes are measured by comparing the current year’s values against those of the base year. A percentage or an absolute comparison may be used in horizontal analysis. Financial statement analysis is the process of analyzing a company’s financial statements for decision-making purposes. Depending on which accounting period an analyst starts from and how many accounting periods are chosen, the current period can be made to appear unusually good or bad. For example, the current period’s profits may appear excellent when only compared with those of the previous quarter but are actually quite poor if compared to the results for the same quarter in the preceding year.

Horizontal analysis makes it easy to detect these changes and compare growth rates and profitability with other companies in the industry. Ratios such as earnings per share, return on assets, and return on equity are similarly invaluable. These ratios make problems related to the growth and profitability of a company evident and clear. The horizontal method of analysis is used to identify changes in financial statements over time and assess those changes.

Vertical analysis expresses each line item on a company’s financial statements as a percentage of a base figure, whereas horizontal analysis is more about measuring the percentage change over a specified period. For example, a horizontal analysis of the cost of insurance might list the cost on a quarterly basis for the past few years, while a vertical analysis would present it as a percentage of sales only for the current period. The value of horizontal analysis enables analysts to assess the company’s past performance and current financial position or growth and project the useful insights gained into the future.

The approach is used to assist in identifying trends or patterns in a company’s business cycle. Financial Analysis is helpful in accurately ascertaining and forecasting future trends and conditions. The primary aim of horizontal analysis is to compare line items in order to ascertain the changes in trend over time. As against, the aim of vertical analysis is to ascertain the proportion of item, in relation to a common item in percentage terms. In horizontal analysis, the items of the present financial year are compared with the base year’s amount, in both absolute and percentage terms.

When it comes to management, it is mostly concerned with the company’s daily operations. So, it may want to use this technical analysis to point out areas that need improvement and that which it should maintain. For instance, the management might compare the cost of goods the company has sold and the realized profit margin over a span of either two or three years. From this, it is able to determine how the efficiency of the company in terms of performance. In other words, it gives the management a benchmark of how future performance should be and the necessary changes required in the future. Generally, horizontal analysis work is to calculate the percentage changes and amount in financial figures from one year to the other.

Recent Comments